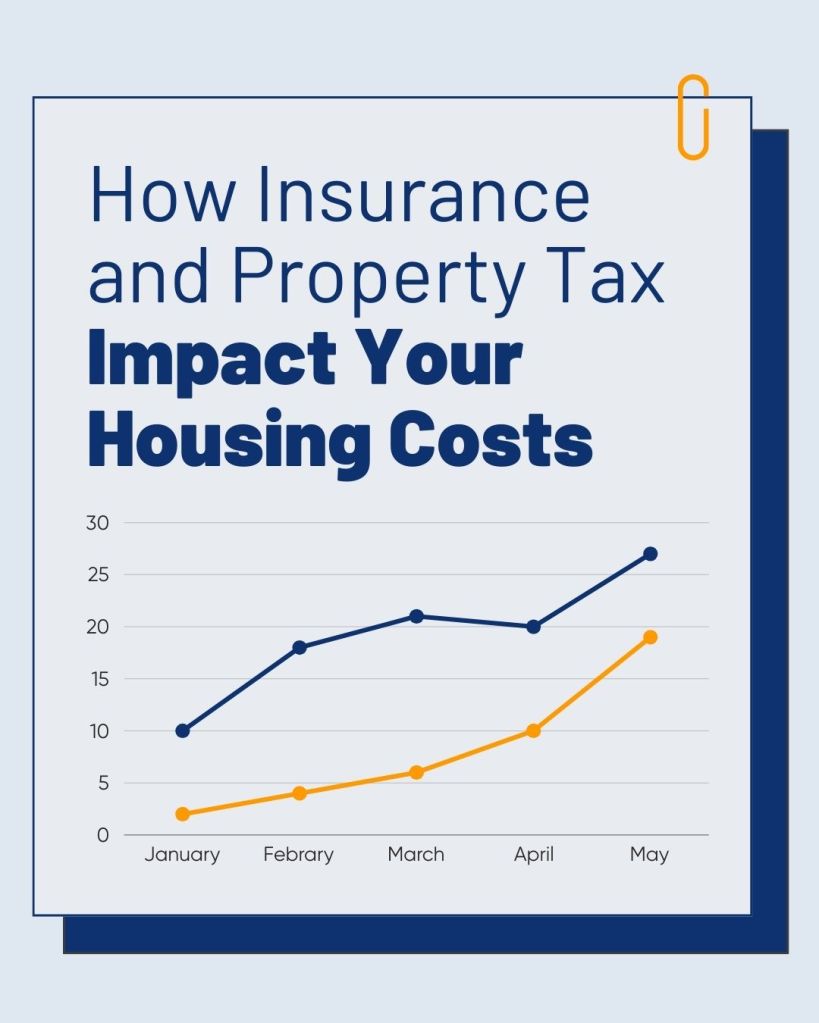

Think your mortgage payment is locked in? Think again. 🔒

While your fixed-rate mortgage provides payment stability, the escrowed components—taxes and insurance—aren’t so stable. As of December 2025, the average insurance premium for a new policy rose 8.5% year-over-year. Climate disasters, higher rebuilding costs, and insurer risk recalibration continue driving these increases with no signs of reversing.

Property taxes aren’t truly fixed either. The average reached $4,271 in 2024, with many homeowners seeing increases of 16% or more. Even where tax rates stay flat, rising home values keep actual bills climbing—creating the irony that your home’s appreciation increases your annual expenses.

The reality: A homeowner can receive a letter from their mortgage servicer saying their payment is increasing $200-300 because insurance premiums rose and the property was reassessed—without moving, refinancing, or renovating. No action taken, yet annual housing costs just jumped $2,400+.

💡 Takeaway: When budgeting for homeownership, expect these “fixed” costs to rise. True stability requires planning for volatility.

The True Cost of Homeownership: What You Pay Beyond the Mortgage

| CALL US AT: 240-630-8689(O)|240-994-8866(C) OR EMAIL US AT: GARCIASHOMES@GMAIL.COM |

#RealEstate #Homeownership #PropertyTaxes #HomeInsurance #RealEstateTips #HomeBuying #CanadianRealEstate #HousingCosts #GarciasHomes #BuyingDreamHomeInMaryland #SellingHousesForTopDollarsInMaryland #MontgomeryCountyMDRealEstate